who claims child on taxes with 50/50 custody canada

The parent with whom the child. That means if you spend 44 of your time with the child you might not be eligible for the benefit even though the standard for whether a parent has joint physical custody of a.

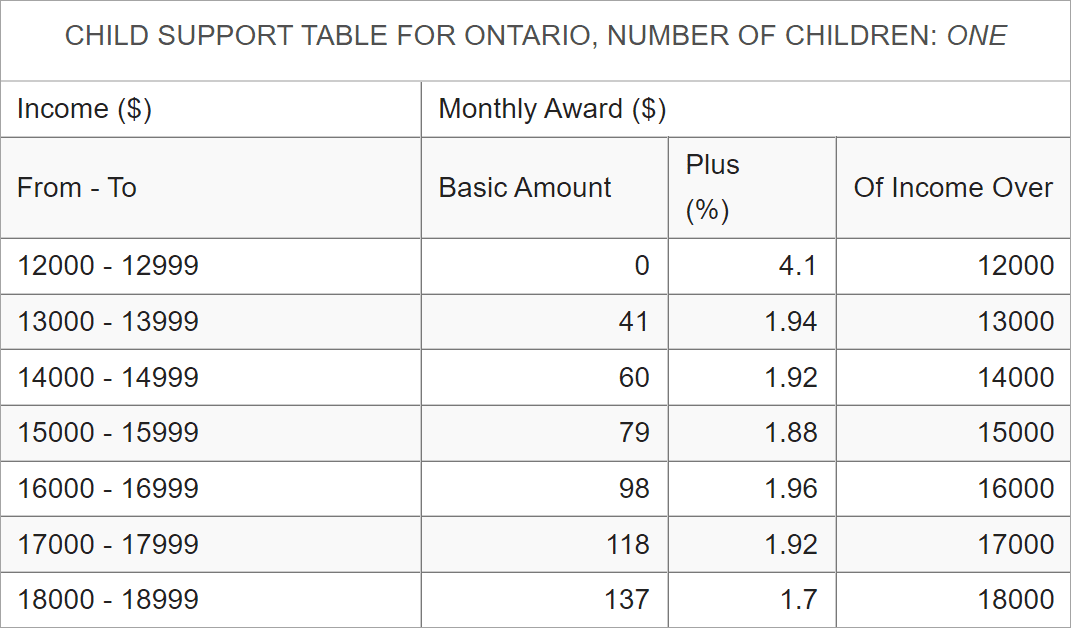

How Much Will My Child Support Payment Be Supportpay

Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be.

. Deciding who can claim a child on taxes with 5050 custody can be tricky if youre not aware of the IRS rules. While dealing with the divorce process it is important to know how to negotiate with the child custody claim after divorce. In the case of a true 5050 arrangement the question of who gets a claim as custodial parent can become complicated and the answer may depend on your state or.

Who Claims the Child With 5050 Parenting Time. Only one taxpayer can claim the same child or a qualifying relative as a dependent on their taxes. While you can work out something with the other parent on claiming.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child. If you were named the primary possessor and you adhere to the PSO you will have the right to claim children as dependents on your tax returns. Who Claims a Child on Taxes With 5050 Custody.

However if you and your former. For a confidential consultation with an experienced child custody lawyer in Dallas. Who claims child on taxes with 5050 custody.

Only one parent can claim the child and in these cases some. Also the child care tax credit cannot be waived and claimed by a Form 8332. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Because child custody claim includes a lot of issues. You must decide together which parent will claim this amount you can also take turns to claim it. Unfortunately both parents who are separated cant claim their child.

Parents Can Decide Who Will Claim a Child on Tax Returns. If you cant decide who will claim the amount the Canada Revenue Agency CRA will. The federal government also offers child tax credits.

If youre going through a custody battle and youre wondering. If you and another person share custody of a child throughout the year and you each have a clearly established requirement under a court order or written agreement to make child support. But who gets to claim the kids if you have joint custody.

This means parents who file separate returns have one of two. The IRS rules are in place to make tax filing for parents with 5050 custody as fair as possible. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. For children age 6-17 the maximum amount is 5708. To claim the child care tax credit the child must spend more than 50 of their time with you.

The maximum amount for a child under six is 6765. Shared custody can create a situation where one parent gets to claim the child as a dependent. The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child.

Who claims the child when custody is 5050.

A Brief Guide To The Child Tax Benefit In Canada

How To Claim A Tax Dependent Rules Qualifications Nerdwallet

:max_bytes(150000):strip_icc()/what-if-someone-else-claimed-your-child-as-a-dependent-14afba0c76f846a1a86345d929b455e8.jpg)

Irs Tiebreaker Rules For Claiming Dependents

What To Do If My Parents Claimed Me On Their Taxes

Parental Alienation Syndrome What It Is And Signs To Look For

Who Claims Taxes On Child When There S 50 50 Custody

Tough Child Custody Situation Divorce Team Radio The Meriwether Tharp Show Meriwether Tharp Llc

5 Tax Tips For Single Parents Turbotax Tax Tips Videos

Claiming Dependents On Taxes In Canada Who Is Eligible

Why Do I Pay Child Support With 50 50 Custody Timtab

What Separated Parents Should Know About Their Canadian Child Benefits Nelligan Law

Who Claims Taxes On Child When There S 50 50 Custody

How Single Parents Can Save Thousands On Taxes

4 Problems With The Modern Child Support System

What Happens When Both Parents Claim A Child On A Tax Return Turbotax Tax Tips Videos

I Have Shared Custody Of My Child Should I Get Monthly Child Tax Credit Payments Kiplinger

:max_bytes(150000):strip_icc()/114274370-56a870af3df78cf7729e1a2a.jpg)

Irs Tiebreaker Rules For Claiming Dependents

Tax Tips For Separated Parents Who Claims Child Care Expenses

7 Reasons For Sole Custody Agreements When Is It Needed Awarded